How Baron Tax & Accounting can Save You Time, Stress, and Money.

Table of ContentsFascination About Baron Tax & AccountingBaron Tax & Accounting Fundamentals ExplainedBaron Tax & Accounting Fundamentals Explained5 Easy Facts About Baron Tax & Accounting ExplainedThe Buzz on Baron Tax & Accounting

And also, bookkeepers are anticipated to have a decent understanding of maths and have some experience in an administrative function. To come to be an accounting professional, you should have at least a bachelor's level or, for a greater degree of authority and expertise, you can become a public accounting professional. Accounting professionals should additionally meet the rigorous demands of the accountancy code of technique.

The minimal credentials for the CPA and ICAA is a bachelor's degree in accounting. This is a starting point for further study. This makes certain Australian organization proprietors obtain the most effective possible financial advice and monitoring possible. Throughout this blog, we've highlighted the big differences between accountants and accountants, from training, to duties within your service.

10 Simple Techniques For Baron Tax & Accounting

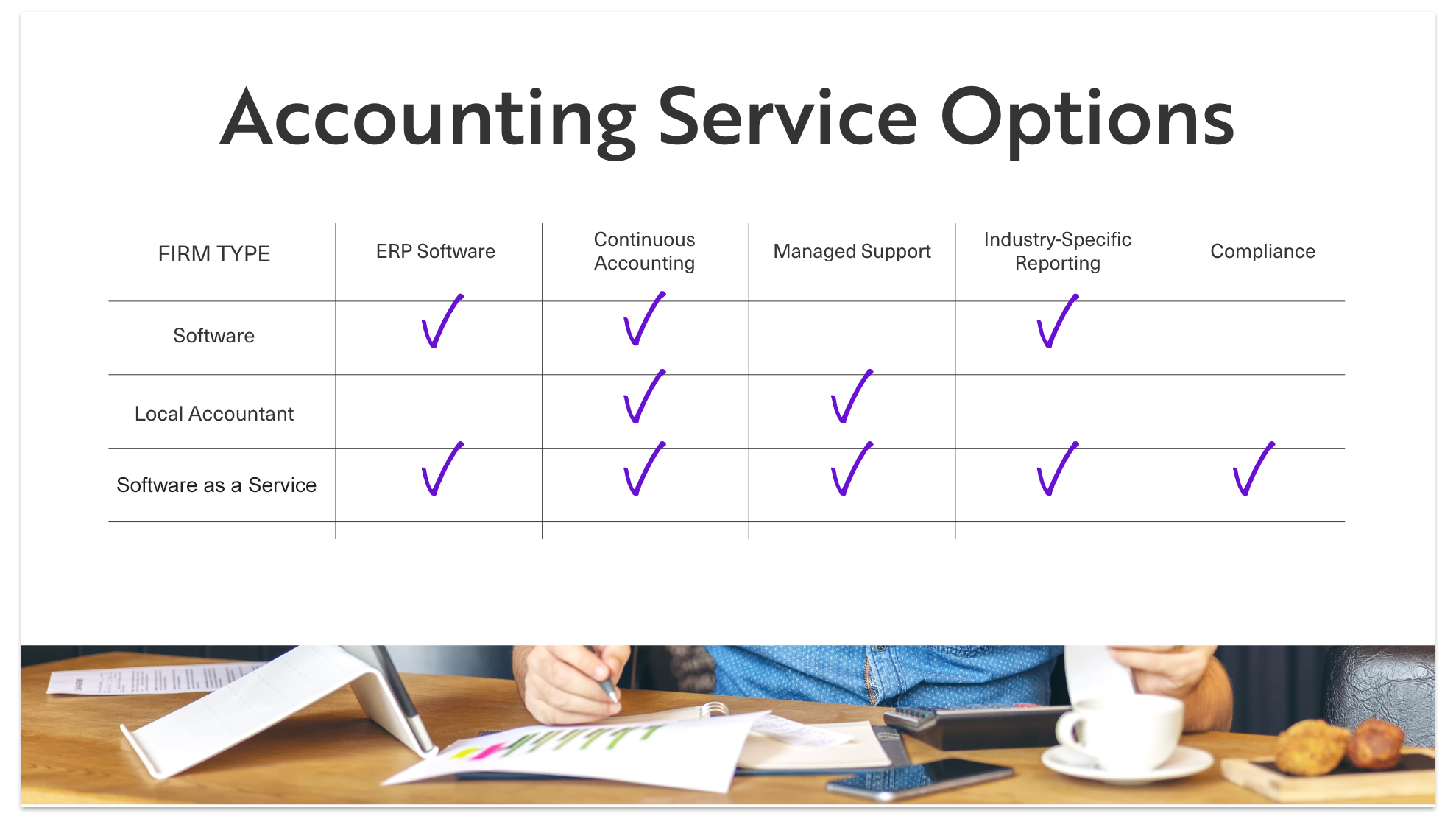

The solutions they supply can maximize revenues and sustain your finances. Services and people should consider accountants a crucial element of monetary preparation. No accounting company supplies every solution, so ensure your consultants are best matched to your specific demands.

(https://go.bubbl.us/e9f0c5/6dfc?/New-Mind-Map)

Accountants exist to determine and update the set quantity of money every worker receives routinely. Bear in mind that vacations and sicknesses influence pay-roll, so it's an aspect of business that you have to frequently upgrade. Retired life is likewise a significant aspect of pay-roll management, particularly offered that not every employee will desire to be signed up or be eligible for your firm's retirement matching.

Our Baron Tax & Accounting Statements

Some lenders and investors need definitive, critical decisions between the service and shareholders adhering to the conference. Accounting professionals can additionally be existing below to help in the decision-making process.

Local business commonly deal with special economic challenges, which is where accounting professionals can provide invaluable assistance. Accountants offer a range of services that aid services stay on top of their financial resources and make educated decisions. Accountants also make certain that businesses adhere to monetary regulations, making the most of tax obligation cost savings and decreasing mistakes in monetary records.

Accounting professionals guarantee that staff members are paid precisely and on time. They compute pay-roll tax obligations, manage withholdings, and guarantee compliance with governmental laws. Handling incomes Taking care of tax obligation filings and repayments Tracking worker advantages and deductions Preparing pay-roll reports Appropriate payroll monitoring stops concerns such as late payments, wrong tax obligation filings, and non-compliance with labor laws.

Some Known Details About Baron Tax & Accounting

This action minimizes the threat of mistakes and prospective penalties. Small company owners can depend on their accounting professionals to handle complicated tax codes and regulations, making the declaring process smoother and much more reliable. Tax preparation is another important solution given by accountants. Reliable tax planning entails planning throughout the year to decrease tax obligation obligations.

These solutions frequently concentrate on service assessment, budgeting and forecasting, and capital monitoring. Accountants assist small companies in determining the worth of the company. They assess properties, obligations, earnings, and market problems. Techniques like,, and are utilized. Accurate valuation assists with selling the company, safeguarding car loans, or attracting financiers.

Guide company owners on finest practices. Audit support aids companies go with audits efficiently and effectively. It lowers stress and mistakes, making sure that organizations fulfill all needed regulations.

By setting practical economic targets, services can assign resources efficiently. Accountants guide in the execution of these strategies to guarantee they align with business's vision. They often evaluate strategies to adjust to transforming market conditions or service development. Risk administration includes determining, examining, and mitigating risks that web could influence a business.

The Best Guide To Baron Tax & Accounting

They guarantee that services adhere to tax legislations and sector policies to stay clear of charges. Accounting professionals also advise insurance policy plans that provide defense versus possible risks, making certain the service is protected against unforeseen events.

These tools help small companies maintain precise documents and enhance processes. is praised for its extensive features. It aids with invoicing, pay-roll, and tax obligation prep work. For a totally free choice, is suggested. It offers several attributes at no cost and is appropriate for startups and small companies. sticks out for convenience of use.